HALLYU STORY WITH STATICS|2023 SURVEY ON OVERSEAS HALLYU STATUES

A Deep Dive Into Hallyu in GermanyMediatalk Plus Researcher·(Former) Korean Foundation for International Cultural Exchange Correspondent in Germany

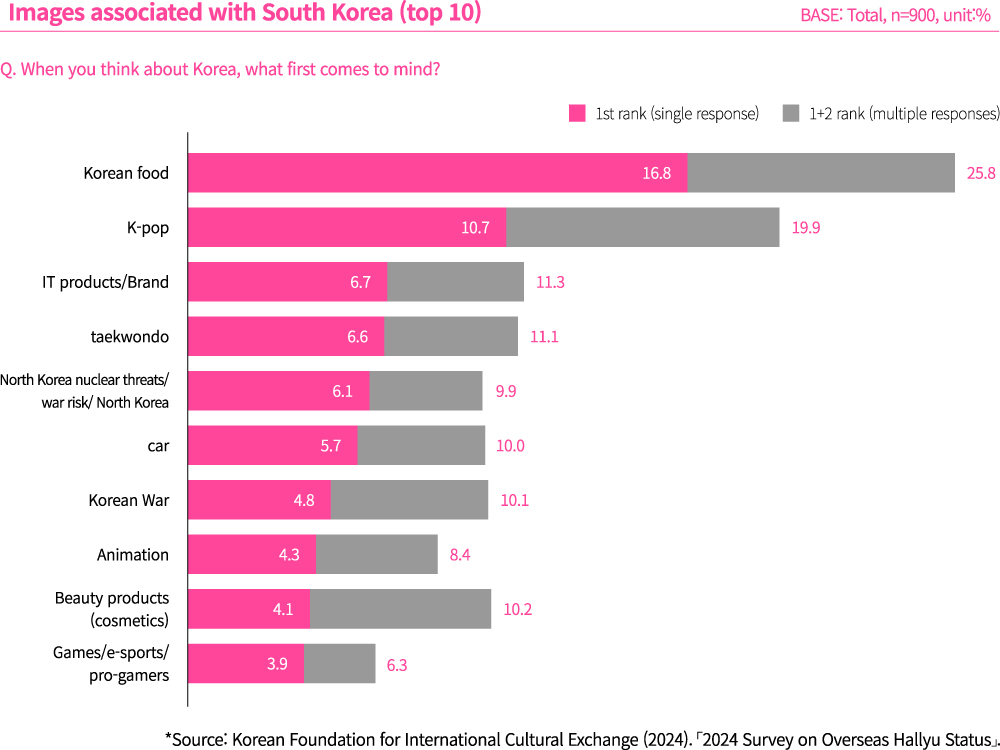

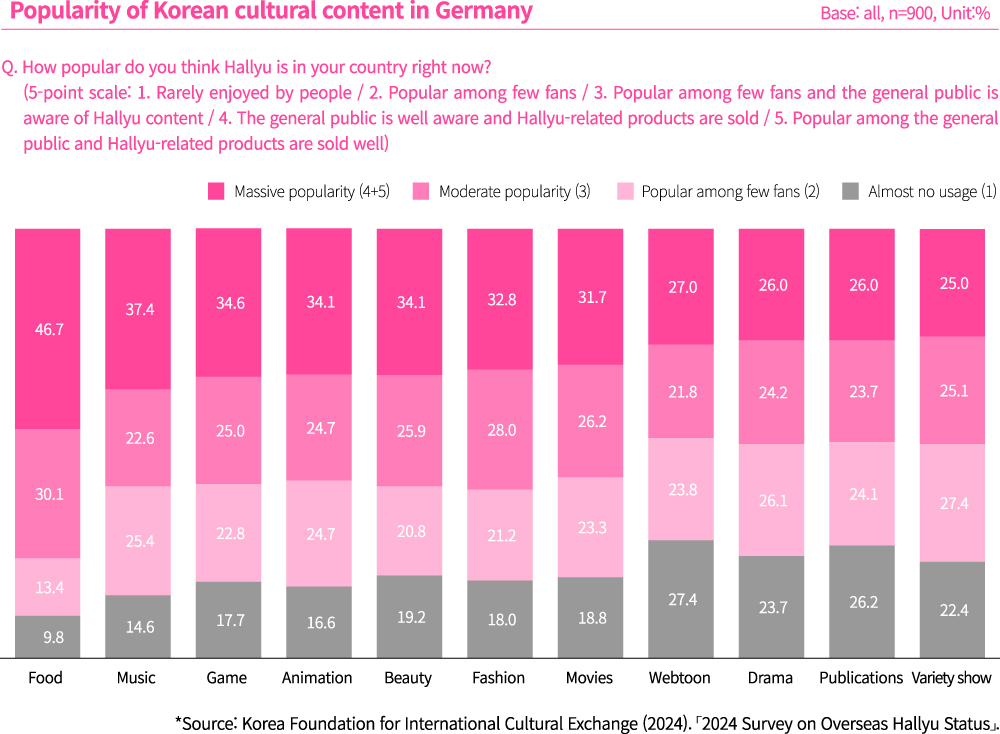

Korean food is the most favored Hallyu sector in Germany. Korean food does not have language barriers and can be most easily and frequently experienced on site. In other words, language is the biggest barrier to consuming Hallyu content. While OTT platforms are lowering these language barriers, the success of “Squid Game” suggests that content stimulating the five senses beyond language still attracts more attention in Germany. There needs to be an opportunity to get past language hurdles and continuously experience the content in order for Hallyu to grow. To achieve this, it's important to consider both the online platforms as well as the functions of users who approach Hallyu as business opportunities in Germany. These are the ones that pervade the German economy and increase the interface of Hallyu in the daily lives of Germans. Hallyu in Germany will continue to be expanded by various players, such as content creators, producers, and intermediaries.

Korean culture in Germany first raised its awareness among film industry workers in the early 2000s through the works of directors who won awards at European film festivals, such as Park Chan-wook and Kim Ki-duk. The first large-scale ‘Hallyu event’ was held when Korea was selected as the guest of honor at the Frankfurt Book Fair In 2005, and since then, K-pop has grown into a subculture among adolescents. Once devalued as the subculture of certain "geeks," K-pop has been reevaluated in Germany's mainstream music industry, as it started to appear frequently on Germany's official music charts, which were seen as conservative and had BTS at the top (Yujin Lee, 2020, September 11). Since then, Korean content flowed in aggressively, with OTT platforms breaking down the language barriers. Due to its high industrial value, Hallyu is becoming more and more prevalent in many domains of German culture.

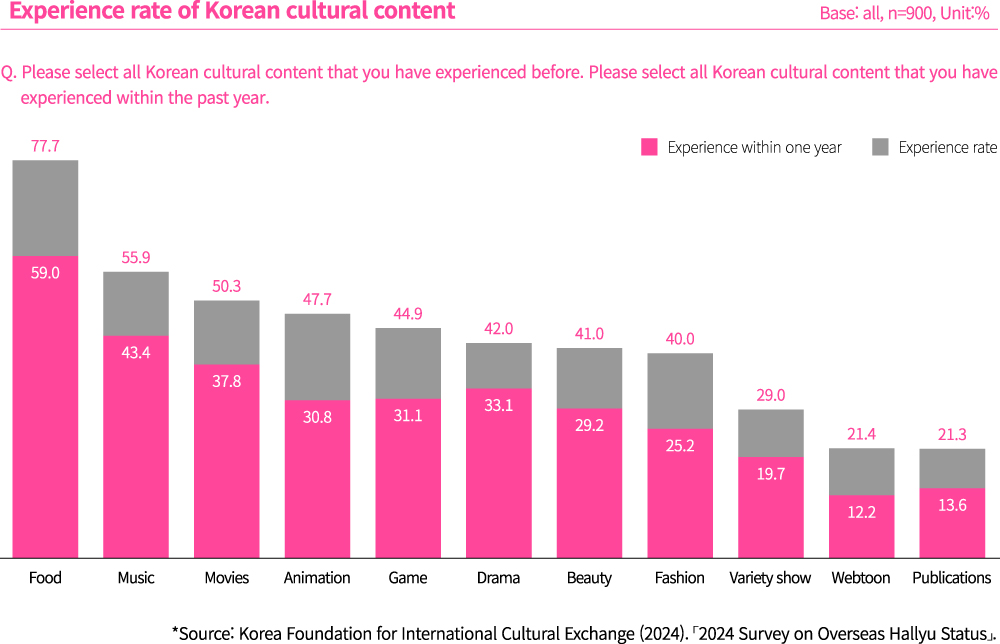

Korean food was ranked first also in the experience rate of Korean cultural content (77.7%) and the experience rate within the past year (59.0%). This indicates that more than 7 out of 10 respondents have tried Korean food, and more than half of the respondents have tried Korean food within the past year. Korean food is no longer an exotic or unfamiliar culture in Germany. It has long become a trend in major cities of Germany, including its capital Berlin, as well as Munich, Hamburg, and Frankfurt. The growth in the Korean food market has led to specialization and segmentation, such as restaurants specializing in specific dishes or fine dining restaurants. There is also an increasing number of Korean restaurants run by not only Koreans but also people of various Asian nationalities, such as Chinese and Vietnamese. Unique new Korean restaurants are opening throughout Germany and are constantly featured in local media. This shows that their accessibility and exposure are increasing, and that they are continuously building a trendy image.

This phenomenon is also found in the grocery market such as major supermarkets in Germany. Large supermarket chains in Germany such as Rewe, Edeka, and Aldi are all introducing Korean dishes and recipes through food content. Recently, small, medium, and large food enterprises in Korea are also enthusiastic about expanding into the German market. Above all, kimchi is no longer just a Korean dish. It now has a distinct position as a fermented health food. The "kimchi" market in Germany is exhibiting industrial potential and is anticipated to grow further in the future as kimchi manufactured by German companies is supplied to local organic food chains and supermarkets.

In fact, according to the 2024 Global Hallyu Trends, language barrier is the biggest factor that hinders the favorability of Korean cultural content in Germany. Respondents chose stories, content, and indirect experience of Korean culture as factors for the popularity of Korean cultural content, and chose translation issues and Korean language difficulties as factors that hinder favorability. This also applies to each field of content. For Korean films and dramas, the biggest factors that hinder favorability were “inconvenient to watch with translated subtitles/dubbing“ (24.9%/26.2%). In most areas of content such as variety shows, music, publications, and webtoons, “inconvenient to watch with translated subtitles/dubbing” and “difficult Korean language” were analyzed as factors hindering favorability.

These statistical findings allow for a reevaluation of the Korean cultural content that has caused a global syndrome throughout the world including Germany. Instead of its lyrics, PSY's "Gangnam Style," which popularized K-pop before BTS, captured the attention of listeners and viewers with its unique, humorous dancing and catchy rhythm. The reason why K-pop was able to expand among teenagers in Germany was because this created a culture where they could enjoy K-pop dance together even without knowing the lyrics or singing along. With Netflix's dubbing and subtitle options, language obstacles were eliminated in the instance of "Squid Game," which ignited the K-drama obsession. Both the drama's eye-catching visuals and the game's simple concepts contributed to the consensus-building that made it popular with the general public. In other words, it was an attractive content that overcame the language barriers, as language did not matter much to begin with.

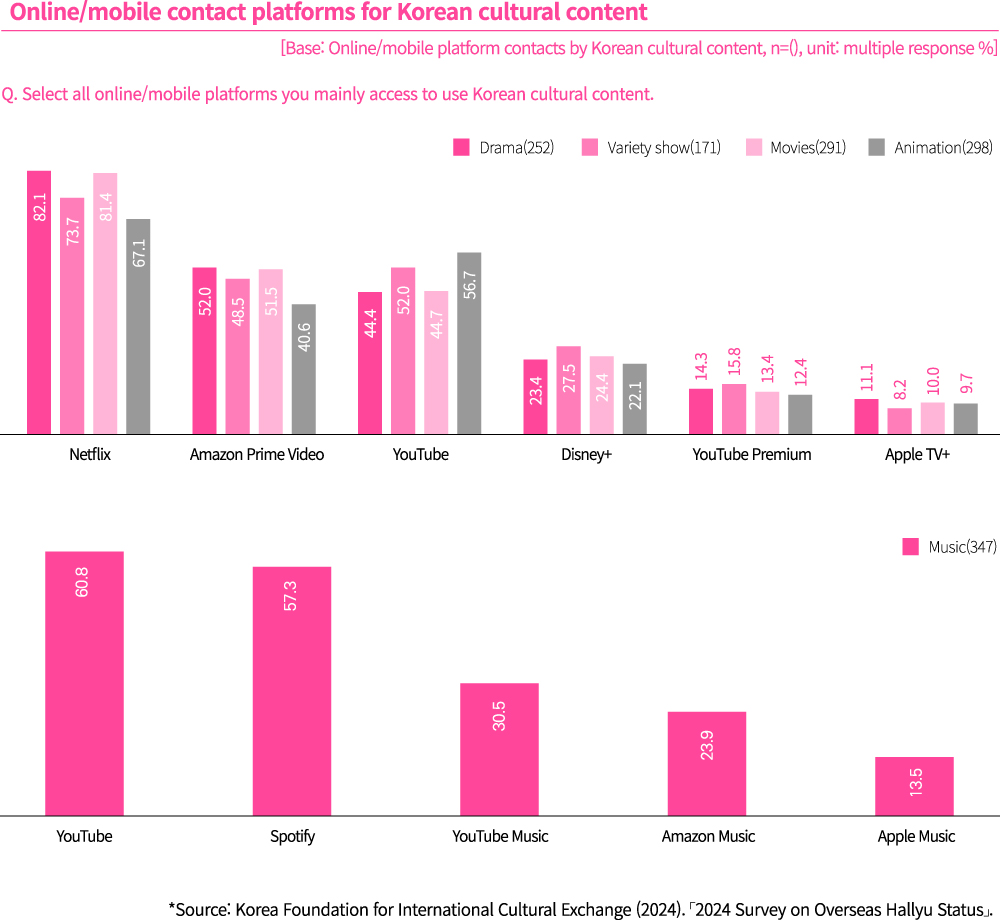

Netflix, a global OTT platform, provided a new turning point in the expansion of Korean content in Germany. Netflix captivated content consumers in Germany by offering multilingual subtitles as well as dubbing services. Korean dramas and films can now reach the public viewers of Germany more easily beyond the gaps in appearance and language. Furthermore, the consumption of digital content has rapidly increased due to the COVID-19 pandemic, and interest in Korean content has further increased since “Squid Game,” with repeated exposures via media such as local articles introducing Korean content.

Meanwhile, according to the profile analysis of Korean content users in Germany, the most preferred drama was “Squid Game” and the most preferred film as “Parasite.” This suggests that there hasn't been any content to surpass the so-called "killer content" that attracted global attention, demonstrating its powerful influence. It seems that content that can not only stimulate the five senses but also break down language barriers using OTT platforms or automatic AI translations and dubbing services will stand a better chance in German and European society, where language barriers are highly perceived when using cultural content.

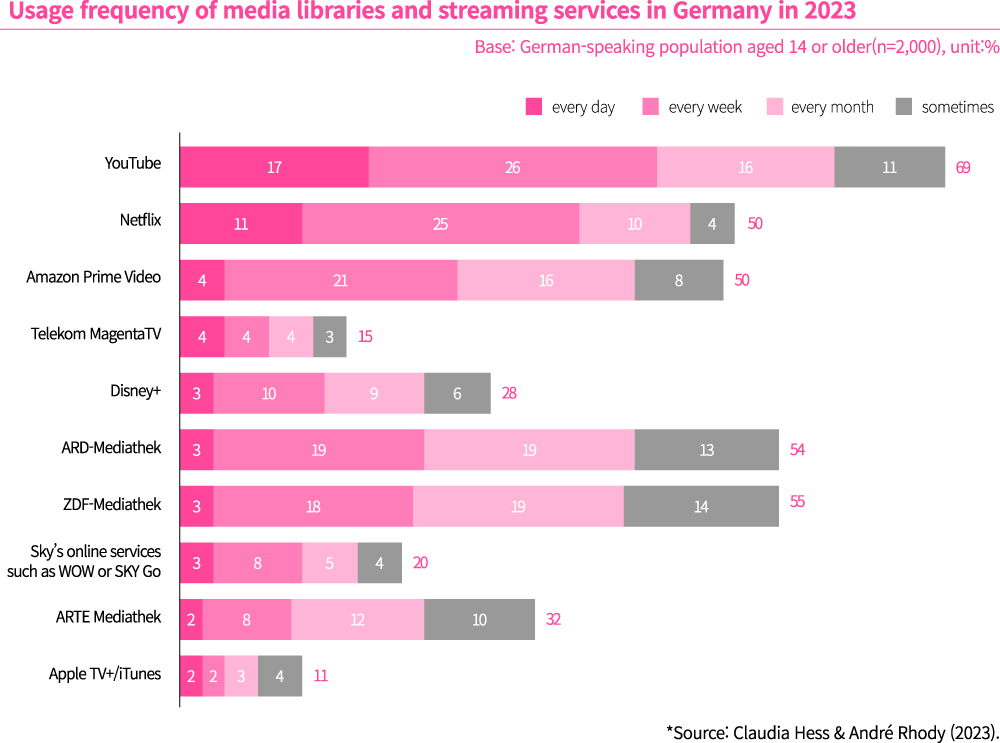

This has to do with the way Germans use media, which is not limited to Hallyu content. According to the ARD/ZDF online study in Germany(Claudia Hess & André Rhody, 2023), 69% of German users aged 14 and older use YouTube, and 50% of respondents use Netflix and Amazon Prime. They also frequently use German public broadcasters’ media streaming services such as ZDF, ARD, and ARTE Mediathek. The majority of Korean content services are offered on global platforms and accessing Korean content on German platforms is relatively difficult. German public broadcasters’ streaming services are platforms that can secure new viewers beyond existing Hallyu fans, which is why there is a need for a strategy to expand exposure through joint filmmaking or documentary production between Korea and Germany.

In particular, large-scale offline Hallyu events have been held one after another since the endemic. In May 2022, a large-scale K-pop concert KPOP.FLEX was successfully held in Frankfurt, Germany, and in 2023, huge Korean cultural events were held in several cities in celebration of the 140th anniversary of the diplomatic ties between Korea and Germany. These events include the Hamburg Port Anniversary as the guest of honor, Hallyu Expo, and Frankfurt Museum Riverside Festival. As for BTS, no large-scale concerts were held due to their military service issues, but their brand was constantly exposed, expanding the scope to various projects such as exhibitions and pop-up stores. Consumers are given adequate opportunities to experience Hallyu content offline, based on their awareness of and preference for the Hallyu content, which has expanded to digital platforms during the pandemic.

Moreover, the current status or influence of Hallyu in Germany must be interpreted in consideration of Germany’s national context and cultural properties. Due to the nature of Germany’s cultural structure which has strong regionality and diversity, it is rare for just one culture or trend to have nationwide influence and awareness. Rather, such phenomenon is viewed as a threat to diversity. It is necessary to understand how Germany handles the element of culture and provide opportunities for mutual experience and exchange through various collaborative projects rather than just unilaterally suggesting Hallyu content.

The 2024 Survey on Overseas Hallyu Status in Germany has significance in quantifying the current status of Hallyu content scattered in Germany. It is an important task to specifically analyze the current status of Hallyu in Germany through statistics and case studies in each sector of Hallyu and introduce it to Germany.